Download My Job Market Paper.

Abstract:

Payday loans are long seen as predatory lending. Many states have taken steps to limit or even completely ban access to payday loans. Some states have passed extended payment plans to prevent consumers from falling into “debt traps.” This paper is the first paper to study the effect of these laws on individual financial health to the author’s best knowledge. Using the synthetic difference-in-differences method, I find that, on average, these laws reduce the total loan past due amount by $25, and it decreases the charge-off amount by $49. These laws are also reducing delinquency rate by about 2.9% and decreasing charge-off or debt in collections by about 2.7%.

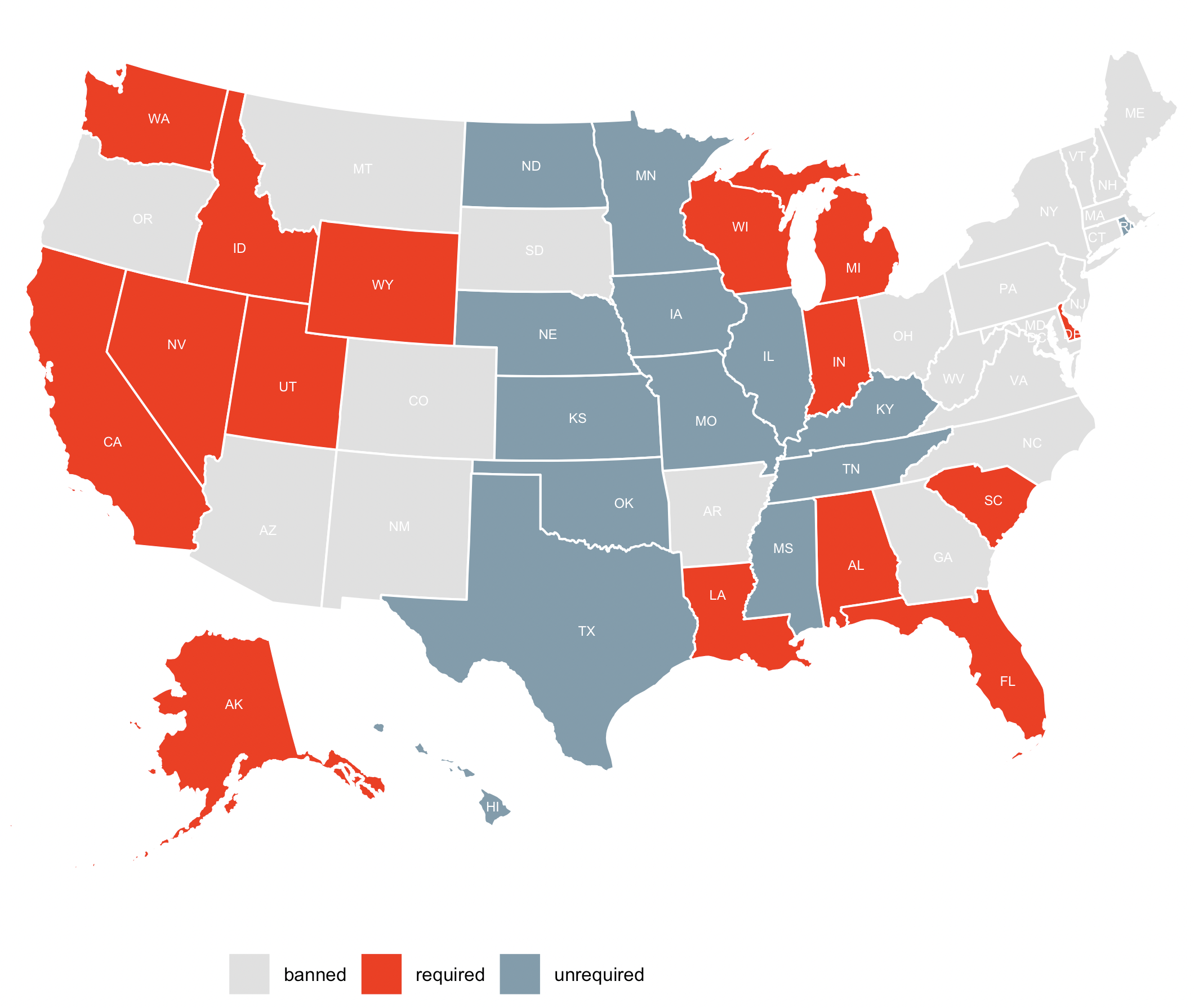

Appendix Figure 1:Payday Loan Legal Status for Each State by by End of 2020

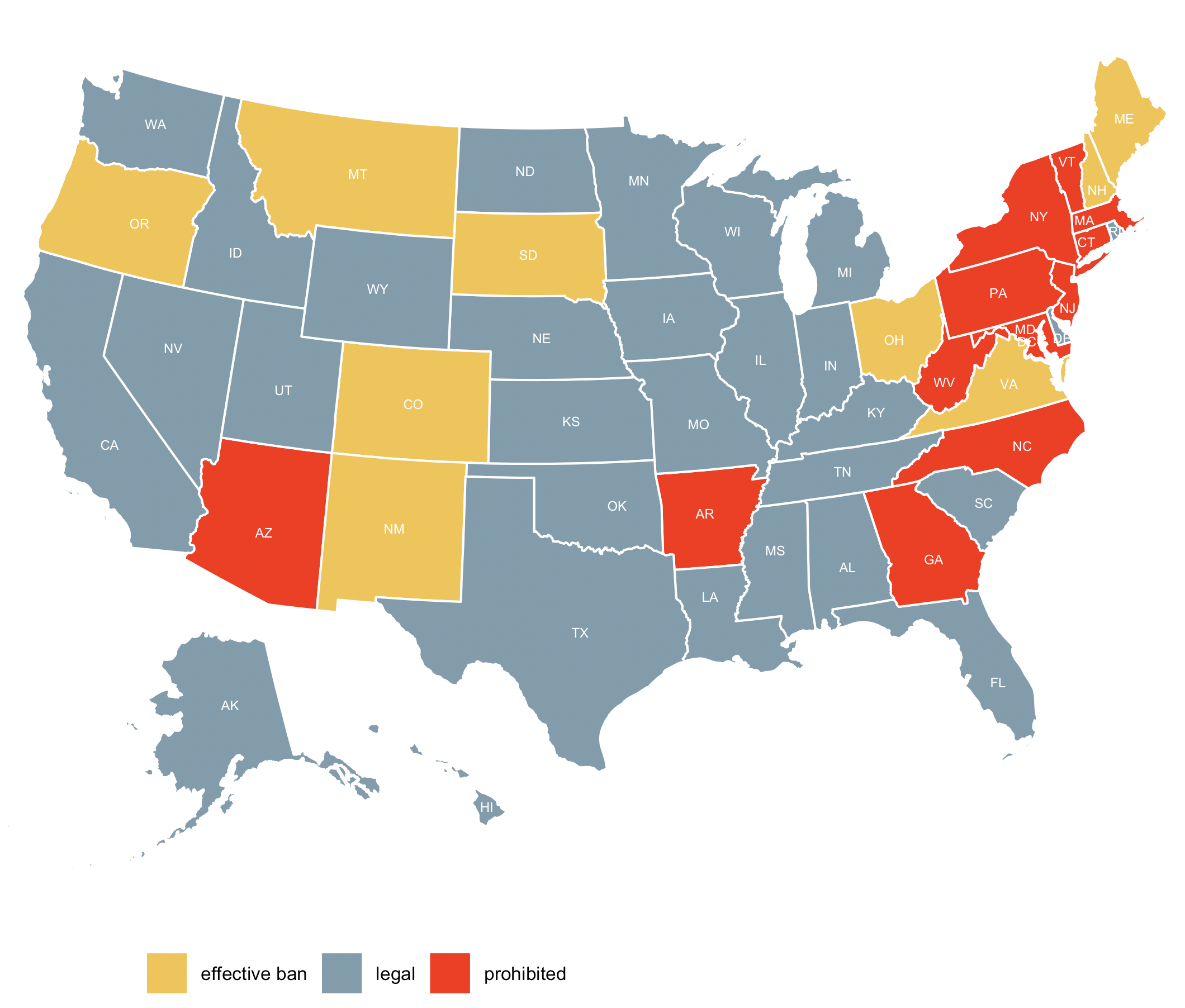

Appendix Figure 2:Extended Payment Plan Laws for Each State by End of 2020